The rise of constellations, the boom in data exchanges, the integration and digitization of network are reshaping the ground segment activity. Innovation will go along with a transformation of the ecosystem, with ongoing and expected transactions on the demand and supply side. Novaspace’s new report projects the competitive ground segment market to reach $8 billion by 2033.

[November 20th, 2024] – Leading space consulting and market intelligence firm Novaspace, a merger between Euroconsult and SpaceTec Partners, has released the fifth edition of its Ground Segment Market Prospects report. Encompassing commercial and governmental satcom, Earth Observation and GSaaS markets, the report provides detailed revenue forecasts and insights into trends that will shape the ground segment market in the coming decade. The report notably explores how this very competitive market is adapting to both eroding demand for traditional applications and the entry of vertically-integrated players who capture a large share of the growth prospects.

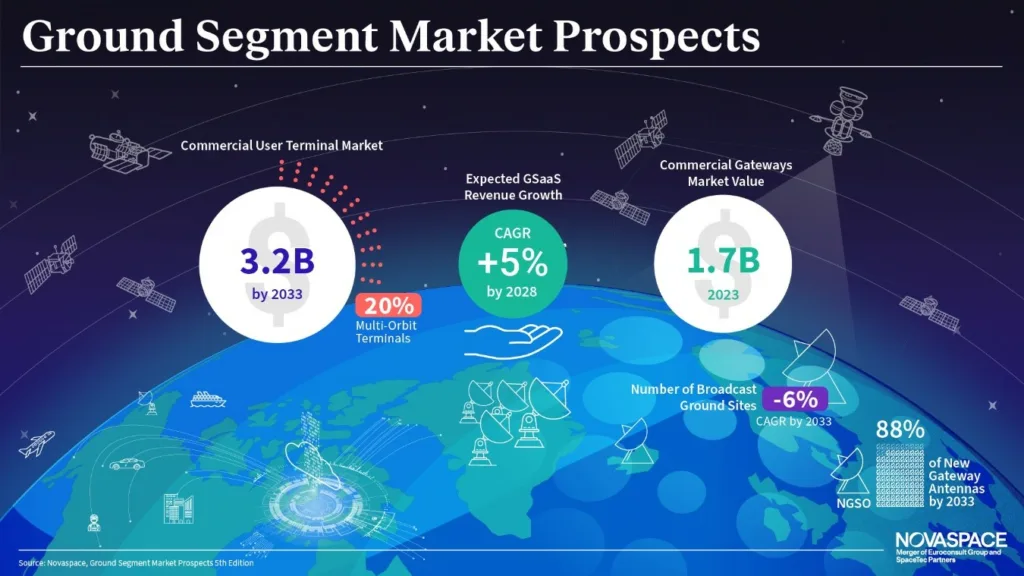

User terminals (UTs) the report highlights a near tripling of the number of commercial satcom UTs in the last three years, fueled primarily by consumer and enterprise segments. Developments in the growing flat panel antenna market are also profiled and, -for the first time-, availability timelines and revenue forecasts for multi-orbit commercial user terminals are included. An outlook for military satellite communications terminals is included, revised upwards from the previous edition, as well as insights and case studies into increased demand due to geopolitical events, such as the ongoing war in Ukraine.

GROUND SEGMENT MARKET PROSPECTS

Gateways and large ground stations – there have been major industry announcements over the past year, such as the spin-off of Eutelsat’s ground segment to Swedish investment firm EQT as well as SES’s acquisition of Intelsat. The report analyzes the impact of these developments and how these trends could be emulated by other operators, whether it be embracing ‘as-a-service’ models and third-party teleports or consolidating and mutualizing gateways.

The addressability of commercial gateways is a notable new feature of this year’s edition. “Our research shows that while commercial gateway antennas are poised to grow in number, most of the growth we are seeing is for NGSO gateways – the vast majority of which are actually captive,” said Alix Rousselière, Consultant at Novaspace. Beyond addressability, the report also examines the critical aspect of regulatory approvals for NGSO gateways – an area that has proven to be a key factor in deployment timelines, as evidenced by recent industry experiences, including Eutelsat OneWeb.

“Though there will always be an incompressible amount of hardware required for satellite operations, both on the ground and in space, there is a marked shift towards virtual and software-defined solutions and associated business models,” Alix Rousselière added. Several key trends will influence the ground segment market, such as virtualization, edge computing, and integration of Non-Terrestrial Network (NTN) standards. The report also addresses optical technologies: optical inter-satellite links (OISLs) and their impact on ground stations, as well as optical ground stations (OGSs), with, for the first time, a high-level market forecast for the latter.

About the Report

The new Ground Segment Market Prospects report, led by Alix Rousselière, Consultant at Novaspace, provides comprehensive insights into satellite ground infrastructure trends, the growing demand for user terminals (including multi-orbit terminals) and the implications of recent market consolidations and divestments. This fifth edition, which also explores the addressability of the commercial gateway antenna market, the regulatory framework for NGSO gateways and perspectives for optical ground stations, is a critical resource for space industry stakeholders, from satellite operators to technology providers and investors. A free extract is available on this link.