Brussels, Hong Kong, Montreal, Munich, Paris, Singapore, Sydney, Tokyo, Toulouse, Washington D.C. – Novaspace, a leading space consulting and market intelligence firm formed by the merger of Euroconsult and SpaceTec Partners, has released its latest edition of the ‘Satellite Connectivity & Video Market’ report, revealing significant shifts across the satellite communications industry.

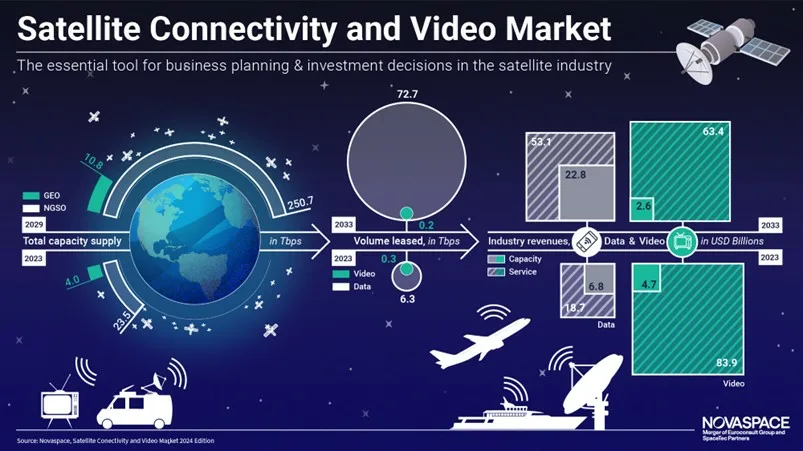

The past three years have seen a dramatic eightfold increase in global satellite capacity supply, reaching around 27 Tbps in 2023, a figure accounted for over 80% by Starlink. This dominance can be partially attributed to delays from initial target dates from most other constellation projects and software-defined satellites. However, new Low Earth Orbit (LEO) constellations such as Telesat, Lightspeed, and Amazon Kuiper, alongside second-generation constellations for Starlink and Eutelsat OneWeb, and Very High Throughput Satellites (VHTS) like Viasat-3, are expected to drive growth to 260 Tbps by 2029.

The rise of Non-Geostationary Satellite Orbit (NGSO) systems has caused a decline in orders for Geostationary Earth Orbit (GEO) satellites as operators have adopted a “wait and see” approach. Despite this, GEO capacity still represented around 85% of capacity revenues in 2023, though NGSO capacity revenues are projected to grow at a Compound Annual Growth Rate (CAGR) of 27%, surpassing GEO revenues by 2028 and wringing in around $18 billion by 2033.

SATELLITE CONNECTIVITY AND VIDEO MARKET

GEO-High Throughput Satellite (GEO-HTS) systems continue to maintain significant traction in premium market segments such as aeronautical connectivity, military satellite communications, and certain areas of fixed broadband, particularly those requiring high uptime or Committed Information Rate (CIR)-based Service Level Agreements (SLAs). However, Starlink accounted for 70% of total HTS traffic in 2023, intensifying competition in key markets like consumer broadband and maritime, further challenging traditional GEO players in these segments.

“Facing a shifting landscape marked by declining demand for video broadcasting, fluctuating mobility market patterns, and an influx of capacity from NGSO constellations, satcom operators have been exploring different strategies to survive,” said Dimitri Buchs, Manager at Novaspace and lead author of the ‘Satellite Connectivity & Video Market’ report.

“In order to expand market reach, diversify service offerings, and enhance business resilience, capacity providers have been increasingly forming ‘multi-orbit’ partnerships. Market segments with lower price sensitivity, such as aero In-Flight Connectivity (IFC) and military communications are expected to drive the majority of demand for multi-orbit connectivity solutions. Overall, multi-orbit service revenues are anticipated to reach nearly $5 billion by 2033“.

In response to rising competition, satellite operators are also pursuing both vertical and horizontal integration strategies. This includes two significant closed merger and acquisition deals in 2023 – Viasat’s acquisition of Inmarsat and Eutelsat’s merger with OneWeb – as well SES announcing it was acquiring Intelsat in 2024, with regulatory clearances expected to be received in 2025.

Consequently, the rising competition should contribute to the Average Revenue Per Unit (ARPU) for satellite capacity falling below $100 per Mbps per month across most segments by 2033. This price decline is set to unlock new opportunities in rural, remote, and under-connected areas, including those near urban centers and over oceans, driving global capacity demand to 73 Tbps by 2033 (27% CAGR).

The industry’s total service revenues are thus projected to reach approximately $117 billion by 2033, capturing the expanding addressable market. However, the anticipated return to growth in service revenues may be delayed due to a continued rapid decline of the video segment in mature digital markets and a stagnation in previously growing emerging markets, such as South Asia. Additionally, delays in the deployment of NGSO constellations and VHTS capacity have also slowed service revenue growth in key data segments such as Enterprise Networks.

About the Report

The ‘Satellite Connectivity & Video Market’ report authored by Dimitri Buchs, Manager of Novaspace, is now in its 31st edition and is an essential tool for satellite communication players as operators, service providers, suppliers, manufacturers, launchers and investors. It provides an in-depth analysis of the conditions driving demand and revenues in the satellite communication market by segment. This report includes historic numbers for capacity supply, capacity leased, service revenue (now broken down by orbit) and capacity revenue, as well as ten-year projections of these numbers in the future.

The new edition now includes a multi-orbit forecast for service revenues and connected terminals, as well as the addition of agriculture to the Land Mobility market segment. It also analyzes enterprise networks in detail, providing detail on capacity ARPUs and revenues split by sub-segment (Rural Connectivity, Civil Government, Corporate Networks and Energy & Natural Resources). Novaspace offers a free extract from the report for download, providing a preview into the key market insights available within the full report.