Maritime and Aero Connectivity segments deeply impacted by worldwide pandemic. Despite headwinds, underlying market drivers to prevail, enabling long-term growth.

Paris, Washington D.C., Montreal, Yokohama, 28 July 2020 – In its latest research titled, “Satellite Connectivity and Video Market”, Euroconsult revised its forecast to account for the impact of COVID-19. The pandemic has deeply impacted maritime and in-flight connectivity demand, and to a lesser extent other segments such as enterprise networks. It remains to be seen how long those markets will take to recover.

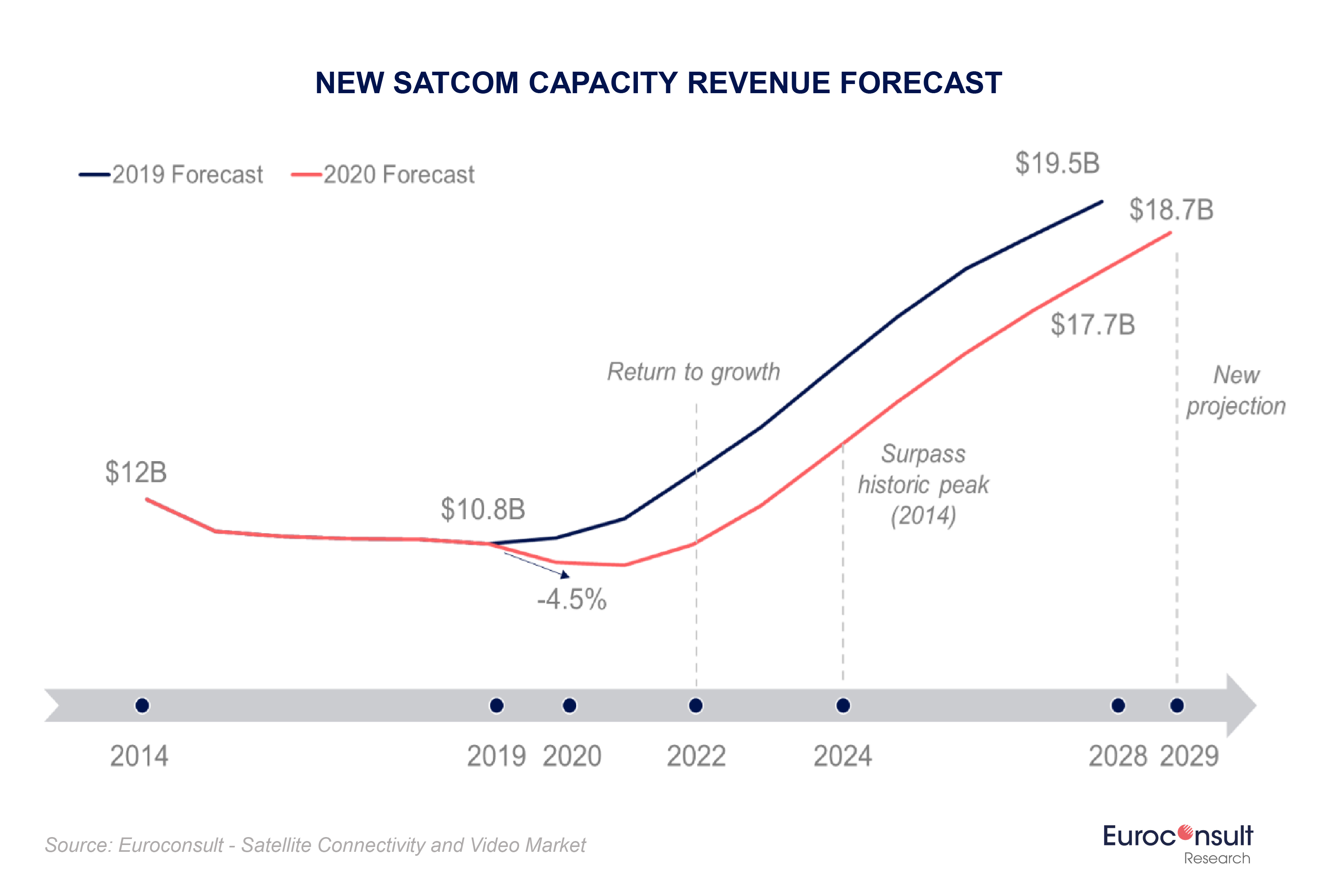

Long-term market drivers for satellite connectivity remain strong and before the pandemic the market was starting to show signs of recovery from the major market price reset. However, due to COVID-19’s impact on bandwidth consumption by cruise ships, commercial airlines, and the energy sector, return to growth previously forecast to begin in 2020 is now unlikely until 2022. According to Euroconsult’s forecast, the satellite and connectivity market is now expected to surpass its historic revenue peak by 2024 and will become an $18.7 billion market by 2029.

“Not all market segments have been negatively impacted by COVID-19,” said Nathan de Ruiter, Managing Director of Euroconsult Canada. “Consumer broadband saw growth in North America following the pandemic, with existing subscribers shifting to higher value plans and overall growth in subscriber base. Nonetheless, temporary supply chain issues have caused delays in new project rollouts in most market segments. Despite the short-term headwinds caused by the pandemic, we expect underlying market drivers to prevail, enabling long-term growth.”

The research discusses structural drivers such as technology push and market pull that exist today and it highlights six conditions that are key for market growth. These include:

-

- •Two large-scale LEO constellations entering full operations within targeted timelines, while hitting capital costs and useable capacity targets

•Advances in NGSO user terminal technology and cost points

- •Lower cost base of satellite capacity translated into reducing end-user pricing levels

- •Sustained government support for universal broadband access

- •Closer integration of satellite into internet service provider and mobile network operators’ distribution channels

- •Adoption of new sales models such as revenue sharing, usage-based models, or co-investment to stimulate market uptake

While market erosion since 2014 was mostly due to oversupply in some regions and the impact of high throughput satellites (HTS), the video market has also experienced marked changes. Whereas video distribution was previously the main driver of satellite revenue, by 2022 wholesale revenue for data applications is projected to surpass video applications. By 2029, data market revenues are expected to represent nearly 80 percent of the satellite connectivity market value.

About the research

An essential tool for operators, service providers, suppliers, manufacturers, launchers, and investors, the “Satellite Connectivity and Video Market ” research – now in its 27th edition – provides an in-depth analysis of the conditions driving demand by market segment. With both a qualitative and quantitative perspective, it breaks down demand by region, application, and system type. The report includes historic numbers for capacity supply, capacity leased, capacity revenue, and the cost of capacity per unit, as well as a ten-year projection of these numbers in the future. It is available now and can be ordered from the Euroconsult shop.