Increasingly challenged by newcomer NGSO constellations like Starlink, legacy GEO operators are adapting by investing in NGSO themselves or partnering with competitor constellations to incorporate them as complementary offerings to their own (two-thirds of such partnerships having been struck with Starlink). In doing so, they are positioning themselves as multi-orbit service providers and network integration service providers and promoting combined offerings said to bring together the best of both worlds for users.

For all the present buzz around “multi-orbit” solutions, there is still confusion around what they entail, what the value is for the user and, the status of the technology. Additionally, key hindrances remain, especially the high cost of sophisticated ground antennas required to handle signals from different orbits (a single such antenna today generally costing upward of $100 000). As such, one should look closely at pertinent use cases and potential clients for multi-orbit services to be able to truly make out market perspectives for multi-orbit satcom services.

Multi-orbit connectivity 101

There are several levels of multi-orbit services. The first is from a supplier perspective: the operation of satellite assets in at least two different orbits, providing an integrated service. Today, only SES (through O3b and now mPOWER) and Eutelsat Group (with OneWeb) fit this category. Other operators have sought to organically become multi-orbit service providers by launching their own NGSO constellation (e.g., Telesat with Lightspeed), acquiring assets in complementary orbits (e.g., HEO operator Space Norway’s purchase of Telenor’s GEO business) or investing strategically in projects using a complementary orbit (e.g., KT SAT with Mangata). However, it has not been expressly announced for some of these players if they will be offering a multi-orbit service.

From a user perspective, multi-orbit services consist in the ability to harness and articulate the signals from several orbits, through two or, ultimately, one terminal. Indeed, having two terminals, one per orbit, is already an existing form of multi-orbit capability (e.g., on a ship, an antenna providing a network for passengers and one for the captain).

More sophisticated multi-orbit solutions involve a single antenna capable of switching between orbits. Some can be manually switched between orbits, giving users the option of connecting to another orbit as a redundancy measure. Manual switching, though less sophisticated, presents the advantage of choosing one’s network and its associated service price. This can help avoid unpleasant surprises when one service is considerably more expensive (the way one might change SIM cards in a phone to avoid roaming fees abroad). Secondly, a user may have single antenna with automatic, fast switching between orbits, using the orbit with the best available network at a given moment (the way a phone switches between WiFi and 5G). Ultimately, multi-orbit services for users entails a single antenna with simultaneous transmission and reception on different orbits.

Whatever the configuration, multi-orbit solutions all aim at combining the best of both worlds: GEO satellites provide reliable and stable connections at competitive costs, while LEO satellites excel in delivering low latency and extensive global coverage, including regions inaccessible to MEO and GEO satellites, such as polar regions and high latitudes. As a result, LEO connectivity is ideal for latency-sensitive use cases like military operations and trading, while GEO satellites tend to be preferred by enterprise customers requiring committed information rates (CIR). New NGSO players like Eutelsat OneWeb and Telesat Lightspeed planning to offer SLAs may redistribute the cards, however, and drive demand for LEO services among corporate clients.

Still-young and very expensive antenna technology

User antennas are the keystone to the emergence of multi-orbit markets, but they are today both immature technologically and far too expensive for high-volume markets. The great majority of single-antenna multi-orbit terminals already on the market (Kymeta, GetSat, Requtech, Thinkom, Intellian, Gilat) today are fast-switching between orbits, a complex feat implying handling rapid satellite-tracking and handoffs amid movements of users and satellites, but not simultaneously receiving and transmitting. Only ALL.SPACE seems to be proposing a single antenna, simultaneous transmit/receive multi-orbit terminal (expected in 2024).

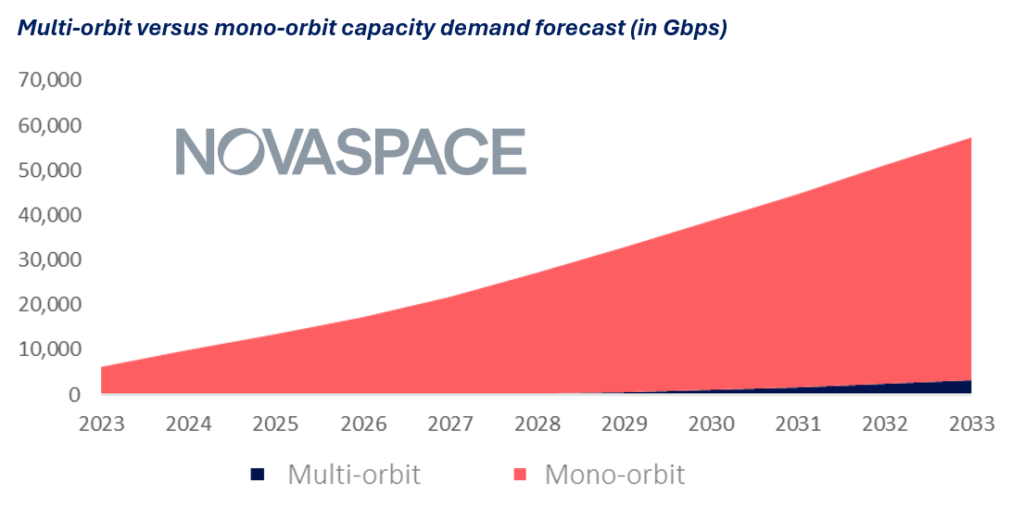

Meanwhile, the price of antennas remains a major inhibitor: Kymeta stands out with the less costly publicly available multi-orbit terminal pricing so far, its u8 Osprey Hybrid GEO/LEO terminal costing in the vicinity of $50K (versus over $100K for ALL.SPACE, Thinkom and Intellian’s rival products). This high cost is the main limitation to widespread adoption looking forward. As a result, this service will therefore likely remain limited at first to the least price sensitive users such as governmental/military users, aviation or the maritime industry. Hence, Novaspace forecasts that over 90% of satellite capacity demand in the coming decade will still target mono-orbit and not multi-orbit services.

In the longer term, as prices decrease, other segments are likely to adopt these services as well. Until then, the partnership model we have been seeing is likely to continue.

Conclusion

Thus, only specific needs and deep pockets justify purchasing the first generations of multi-orbit antennas due to their high price, reserving them for niche markets in the near future. Furthermore, while a single multi-orbit antenna is advantageous for size-constrained applications (to fit on a plane, for example), the argument of having a single multi-orbit terminal for redundancy purposes does beg the question; is having two antennas not inherently more resilient?

In the long term, emerging multi-orbit solutions may pave the way to network agnosticism, where the user would not necessarily know which network they’re connecting to, whether it’s LEO, MEO, GEO, or terrestrial, and – frankly – will not care, as long as their connection is high-speed, stable, and has a reasonable cost of service.