10% average revenue growth over 2019-2023

Paris, Washington D.C., Montreal, Yokohama, June 12, 2019 – According to Euroconsult’s latest report, Prospects for Maritime Satellite Communications, the maritime connectivity market continues to be vibrant, as shipowners transition to the next level of broadband connectivity. The merchant, passenger and leisure segments have all been supporting growth in revenues and capacity usage, while a rebound on oil pricing would accelerate the offshore segment. In addition to capacity, an increasing focus is on the supply of value-added services and on the outsourcing of daily operations by shipping companies.

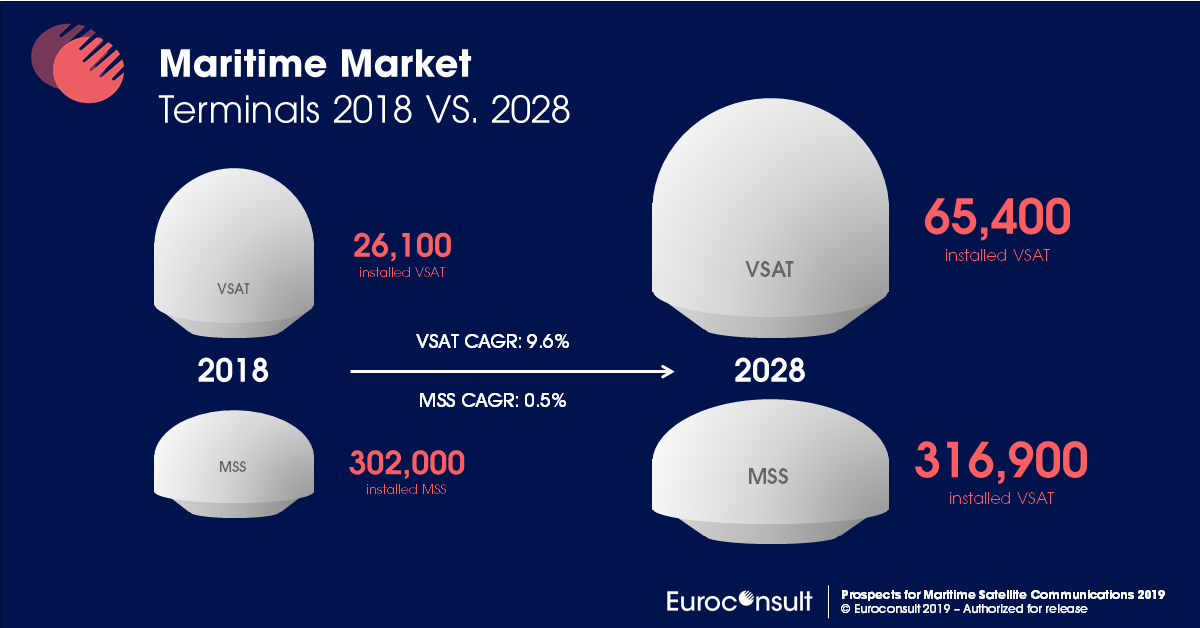

The maritime satellite VSAT communications market experienced extensive growth in 2018, with the number of terminals increasing by almost 18% YOY and reaching 26,000 at year-end 2018. VSAT services revenue exceeded $1 billion, resulting in growth of almost 11% compared to the previous year. Increasing demand from passengers, as well as regulatory pressure on communications and crew welfare are major factors pushing maritime operators to install new generation satellite systems on their vessels. In addition, decreasing prices for capacity and terminals encourage more customers to adopt VSAT services, while existing clients transit to higher data packages. HTS capacity is rising fast and is expected to grow even faster in the next five years, as new operators enter the market. Hardware, such as receiving antennas and modems, is also evolving rapidly; smaller, lighter, and more efficient antenna systems are gaining traction as the industry constantly evolves.

“The VSAT market is anticipated to grow quickly; the number of terminals should increase to more than 65,000 in 2028,” said Xavier Lansel, Senior Consultant at Euroconsult. “As a consequence, VSAT solutions will generate more than 90% of the maritime satellite communications revenue in 2028. VSAT revenue is anticipated to increase to $2.7 billion by the end of the decade.”

For the maritime market, if all satellites are launched as planned, the total available GEO HTS capacity over oceanic regions will grow from about 100 Gbps in 2018 to around 680 Gbps in 2023. By then, Ka-band systems will stand for over 90% of GEO HTS satellite capacity over oceans. Capacity leased for maritime applications is anticipated to grow tremendously from 27 Gbps in 2018 to almost 370 Gbps in 2028, at 30% CAGR. Capacity consumed per vessel should peak, driven by crew and passenger applications. Over the longer term, several global constellations with very high capacity might be launched, which would significantly increase the HTS capacity supply available over oceans. As a result, operator revenue is expected to grow from around $560 million in 2018 to almost $2 billion in 2028.

About the Report

Prospects for Maritime Satellite Communications provides an in-depth view of the sector dynamics, analysis and forecasts for the maritime satcom market. Along with consolidated data and analysis, a detailed analysis of the major addressable maritime market segments is given, including merchant shipping, passenger ships, leisure vessels, offshore oil & gas, and fishing. The report covers the maritime value chain, from service providers like KVH, Inmarsat, Marlink, Speedcast, RigNet, Global Eagle, to equipment manufacturers like AddValue Technologies, Cobham, Furuno, Hughes, iDirect, Intellian, and operators like Intelsat and SES.