By 2033, satellite demand is expected to reach an annual average of 3,700 units, with sustained growth primarily fueled by select key NGSO constellations, while demand for GEO communication satellites will settle due to consolidation of satcom operators. While commercial operators will account for 80% of satellite volume, government customers continue to be the market’s cornerstone, representing two-thirds of its total value.

Brussels, Hong Kong, Montreal, Munich, Paris, Singapore, Sydney, Tokyo, Toulouse, Washington D.C. – Novaspace, a merger between Euroconsult and SpaceTec Partners, the leading space consulting and market intelligence firm announces the release of the highly anticipated 27th edition of “Satellites to be Built and Launched” forecasting a record-breaking surge in satellite demand through 2033.

This edition forecasts an average of over 3,700 satellites launched annually between 2024 and 2033 – equivalent to 10 satellites per day and totaling a mass of 7 tons – reflecting the growth of satellite-driven connectivity and data services. The report sheds light on the long-term dynamic of the satellite market, emphasizing sustained demand, changes of end users habits, and the seismic shifts caused by vertical integration of selected players and a particular focus on the issues experienced by vendors.

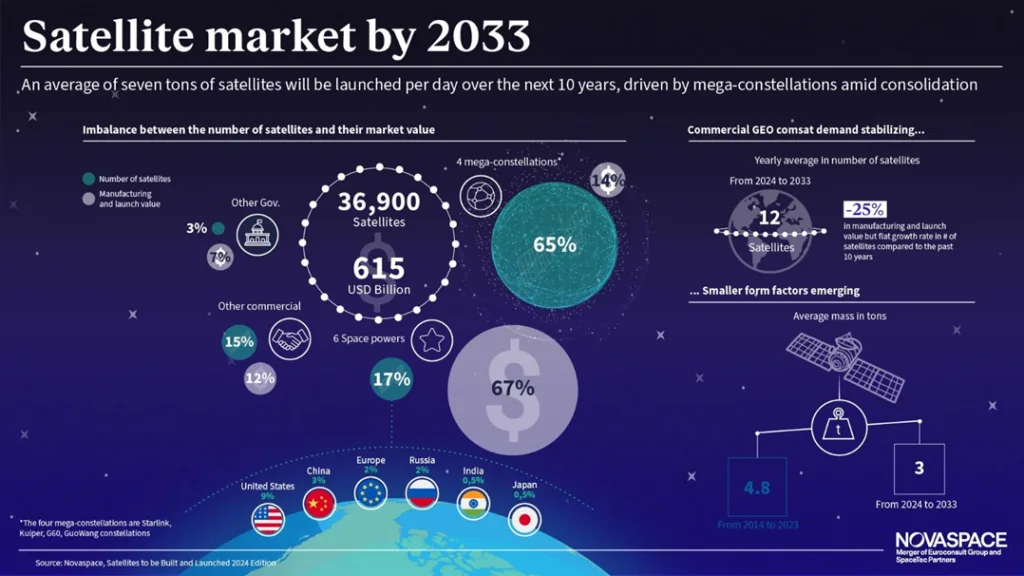

A report key finding is the growing concentration of satellite demand among a handful of mega-constellation operators. Respectively, four commercial broadband non-geostationary orbit (NGSO) mega constellations are transforming the landscape of satellite manufacturing and deployment, particularly in the pursuit of global connectivity. Starlink, Kuiper, G60, and GuoWang constellations alone will account for 65% of the demand in number of satellites but only 14% to the overall manufacturing and launch value as their vertical integration will enable massive economies at scale.

In contrast, 2,900 satellites weighing more than 500 kg each and operated by 170 satellite operators, will represent 70% of the satellite manufacturing and launch market value but only 7% of the total number of satellites. This reflects the diversity of use cases, orbits, performance needs, mass, and form factors.

The report indicates that demand for commercial geostationary orbit (GEO) communication satellites will remain stable compared to the past 10 years, with an average of 12 yearly orders, while the combined manufacturing and launch value is expected to decline by 25%, driven by a wider variety of satellites, including smaller assets.

Furthermore, recently successful mergers and acquisitions between GEO comsat satellite operators Viasat – Inmarsat and Eutelsat – OneWeb, as well as ongoing negotiations between companies like SES and Intelsat , will lead to fleet rationalization and multi-orbits strategies.

On the government side, civil and defense agencies from the six leading space-faring public bodies alone (U.S, China, EU, ESA, India, and Japan) will concentrate two-thirds of the demand in manufacturing and launch market value.

SATELLITE LAUNCHING AND MANUFACTURING: NGSO CONSTELLATION AND GOVERNMENT DRIVE DEMAND

The growing market dominance of a few large commercial satellite operators could exert pressure on both smaller competitors and suppliers. Established satellite manufacturers, already grappling with cost pressures and demands for greater efficiency, may face further margin compression as these major operators push for more favorable pricing. As a result, mergers or partnerships among satellite manufacturers may become essential to stay competitive.

Maxime Puteaux, Principal at Novaspace and editor of the report stated “The growing concentration of demand from a small number of vertically integrated customers, along with end-user requirements for cost effective services, will push towards consolidation across the value chain, from satellite operators to their suppliers.” He added, “However, while the demand for satellites is booming, the industry faces substantial challenges in terms of manufacturing capacity, launch infrastructure, and market concentration. Although the end of the scarcity of Western launchers is approaching, it has yet to significantly impact the ongoing bottlenecks and challenge SpaceX’s dominance.“

Forecasts rely on thorough satellite demand through an assessment of downstream markets, satellite operators’ strategy, maturity, and new players. As the future of satellite demand does not result from the sum of the projects currently known, Novaspace applies various discount factors to them depending on their maturity, resulting in a fraction of constellation projects – at various stages of development – featured in the forecast. All figures presented are derived from Novaspace’s opinion and do not necessarily reflect the views of operators.