The number of in-flight connected aircraft is projected to surpass 60,800 by 2033 with multi-orbit solutions helping reshape the market as airlines transition from legacy systems. Technical advances are fueling bandwidth growth and reducing costs, while satellite operator revenues are set to rise over the next decade as the increasing demand for in-flight connectivity delivers significant market transformation.

Brussels, Hong Kong, Montreal, Munich, Paris, Singapore, Sydney, Tokyo, Toulouse, Washington D.C. – Novaspace, a merger between Euroconsult and SpaceTec Partners, the leading space consulting and market intelligence firm, has released its 12th annual report ‘New Prospects for In-Flight Connectivity’ which reveals continued growth in the market. It highlights key global trends, including an increase in connected aircraft, the rise of NGSO-based satellite services and the growing impact of mergers and collaborations between service providers.

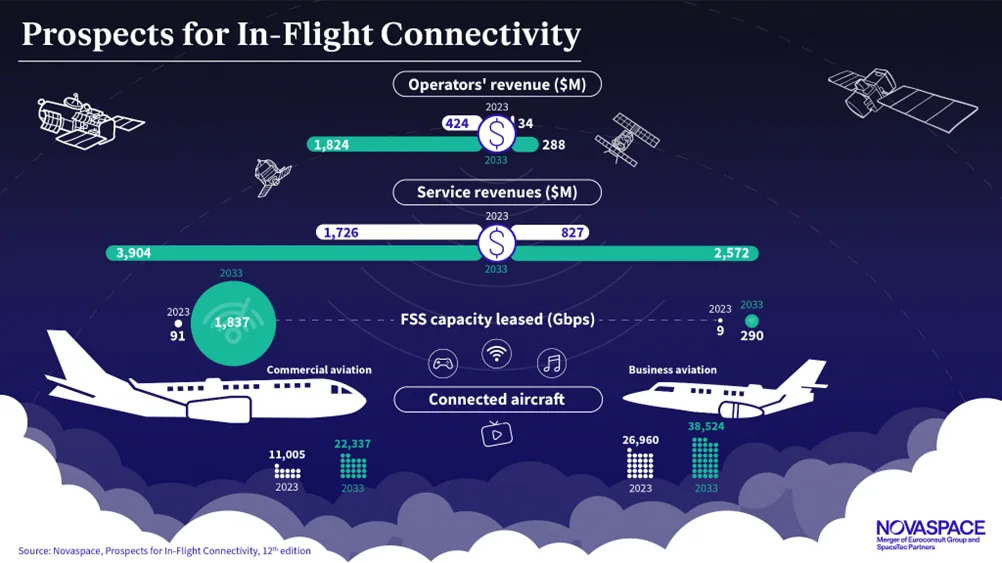

The number of In-flight Connectivity (IFC)-equipped commercial aircraft surpassed 11,000 in 2023, with overall connectivity reaching 38,000 aircraft – an increase driven largely by the business and general aviation sector, which holds nearly 68% of the market. The number of connected aircraft is projected to exceed 60,800 by 2033, signaling a steady upward trend as airlines adopt new technology and service offerings.

Growth in the number of connected aircraft is slightly impacted due to the airlines migrating from existing IFC services to the new services. Novaspace anticipates that this trend will continue with the introduction of advanced technologies and an expansion of new service offerings.

“We see a natural evolution in the market as airlines transition from legacy GEO-based systems to more advanced NGSO-based services and hybrid solutions,” says Vishal Patil, project manager at Novaspace. “This shift is already driving significant changes in bandwidth consumption, with total leased capacity expected to rise from 90 Gbps in 2023 to a staggering 1.8 Tbps by 2033. These figures highlight the importance of connectivity in modern aviation.”

PROSPECTS FOR IN-FLIGHT CONNECTIVITY

The report underscores the impact of NGSO-based services, such as those offered by Starlink and OneWeb, which are set to revolutionize in-flight connectivity by offering greater bandwidth at reduced capacity costs. These services, which entered the market in 2023, have already gained early adopters such as JSX, Hawaiian Airlines and AirBaltic. In late 2023, Qatar Airways became the largest carrier to sign on with Starlink, followed by United Airlines in 2024, contracting the solution for 1,000 aircraft.

“NGSO-based solutions are rapidly gaining traction, especially as airlines recognize the benefits of enhanced connectivity,” says Patil. “However, this growth is being tempered by the need for proven equipment, which for now remains a hurdle for large-scale deployment.”

The report also highlights the growing trend toward multi-orbit solutions, which combine GEO (geostationary), MEO (medium) and LEO (low Earth orbit) networks to improve service reliability and coverage. Mergers and collaborations, such as the SES-Intelsat merger and the OneWeb partnership between Intelsat and Eutelsat, are expected to help reshape the future of in-flight connectivity by offering multi-orbit capabilities.

Despite the challenges of migrating to new technologies, the report remains optimistic about the future. Satellite operator revenues are expected to grow from $458 million in 2023 to $2.1 billion by 2033, with commercial aviation contributing 86% of total revenues.

“The market is clearly headed for strong growth, with both existing and emerging technologies driving bandwidth consumption and overall service improvement,” says Patil. “The aviation sector is recognizing the value of reliable, high-speed in-flight connectivity, which is quickly becoming a passenger expectation rather than a luxury.”