Advances in technology and data analytics are propelling significant growth in the global Earth Observation market, leading to a rapidly expanding network of satellite manufacturers and service providers.

Brussels, Hong Kong, Montreal, Munich, Paris, Singapore, Sydney, Tokyo, Toulouse, Washington D.C. [11th July 2024]. The global Earth Observation (EO) satellite market will undergo substantial growth over the coming decade, with the number of EO satellites in orbit expected to almost triple as the manufacturing market grows by 40% and the value of the launch market increases by 55%.

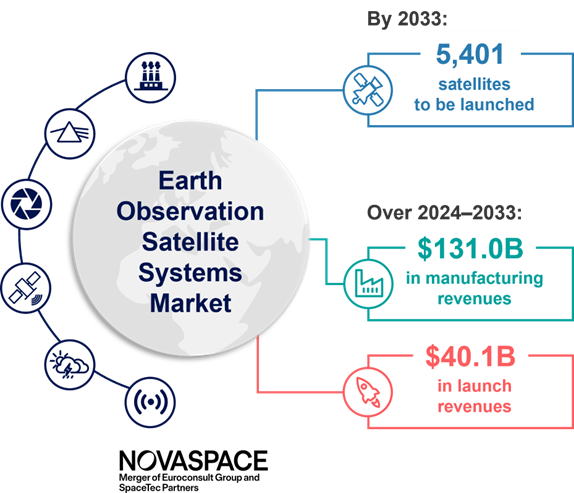

The latest Earth Observation Satellite Systems report from Novaspace, a merger between Euroconsult Groupand SpaceTec Partners, the leading space consulting and market intelligence firm, predicts 5,401 EO satellites will be launched between 2024 and 2033. This is up from 1,864 launched over the previous decade and marking a 190% increase.

Market growth is being driven by technology miniaturization enabling a new breed of EO satellites to carry a diverse array of instruments. These range from Very High Resolution (VHR) to Very Very High Resolution (VVHR) Multispectral, Synthetic Aperture Radar (SAR), Hyperspectral, Greenhouse Gas (GHG) monitoring, Electronic Intelligence (ELINT)/RF, to Meteocean sensors. Miniaturization is also facilitating the deployment of smallsat constellations across a wider variety of orbits, including Very Low Earth Orbit (VLEO) and inclined trajectories.

THE MARKET FOR EARTH OBSERVATION SATELLITE SYSTEMS

EO upstream market expansion is further supported by a burgeoning ecosystem of satellite manufacturers and payload providers, along with advances in computational capacity and data analytics. These developments have led to the creation of low-cost platforms and payloads capable of delivering high-quality operational services that were once only achievable with larger satellites.

Manufacturing revenues are projected to reach $131.0 billion and launch revenues expected to hit $40.1 billion within the decade, increases predominantly driven by government customers. Global investment in economic recovery and innovation, including new civil constellation programs in countries like Italy, South Korea and the UAE, is also accelerating this growth.

“The rapid advancements in technology and increasing investments by governments worldwide are setting the stage for a dynamic and robust EO satellite market,” said Novaspace Expert, “This growth presents significant opportunities for both government and commercial operators to leverage new capabilities and services.”

The 2024 edition of Earth Observation Satellite Systems provides detailed forecast reviews based on recent budget announcements, defense programs and civil initiatives, also including details on business opportunities and challenges for commercial operators globally. It covers global EO satellite demand dynamics and forecasts for the next decade compared to the previous decade, including insights into the satellite manufacturing market and ecosystem overview. A key focus of the report is on the manufacturing and launch markets and their anticipated evolution over the next 10 years for commercial civil government and unclassified defense satellites.