Current on-orbit transportation and servicing trailblazers are poised to build a network of future space highways.

Paris, Washington D.C., Montreal, Yokohama, Sydney, May 18, 2022 – A nascent but growing set of on-orbit space services, to be articulated as a space logistic ecosystem from launch to satellites’ end of life, are being developed by more than 50 companies. According to Euroconsult’s 1st edition of Space Logistics Markets report, this diverse set of on-orbit services is expected to generate $4.4 billion by 2031.

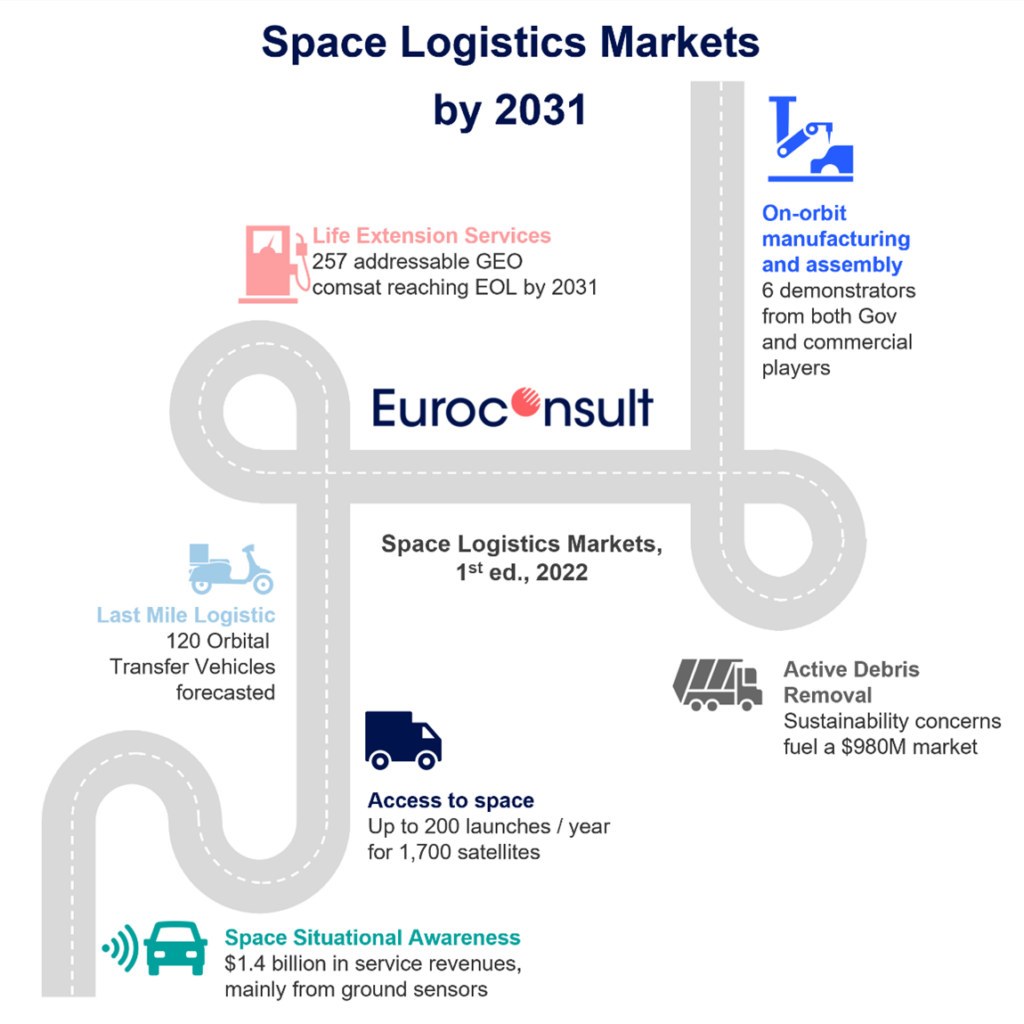

The six markets covered in this report highlight the development of end-to-end on-orbit mobility and associated services through Access to space, Last Mile Logistics (LML), Life Extension, Active Debris Removal (ADR), On-orbit Assembly and Manufacturing (OOAM) and Space Situational Awareness (SSA) at different stages of maturity.

The markets’ maturities are uneven across the space logistics value chain, with the report estimating SSA as the largest market with earnings of $1.4 billion over the next ten years, and LML evaluated as ten times smaller. A continuously growing satellite demand and a congested orbital environment are fueling the need for SSA services, whilst satellite operators are endorsing SSA services to increase domain awareness and protect their assets both above and on the ground.

Like any other satellite business, Government players will play a key role in increasing Technology Readiness Levels (TRL) and becoming early customers by providing suitable regulatory frameworks and unlocking more funding. However, whilst a larger ecosystem could materialize by combining applications, competitions between each other also need to be considered.

Space logistics markets are leveraging on multiple rapid changes across space industry access that could lead to an average of 220 launches in the next 10 years in the most optimistic scenario. Despite a 52% increase in value between 2012- 2021 and 2022-2031, Euroconsult anticipates that the average launching price will be divided by a three-fold factor. This is due to the emergence of new vendors, ranging from dedicated smallsat access to space to super-heavy reusable launchers with various design-to-cost value propositions. With a new generation of GTO-capable (Geostationary Transfer Orbit) launchers expected, the market is currently experiencing a challenging transition with a short-term bottleneck. However, with reusability on the horizon gradually being endorsed by competitors of current master SpaceX, super heavy and fully reusable launchers currently under-development could disrupt satellite design and fuel elasticity in the launch demand.

Space logistics suppliers are integrating their technologies and services in the already existing satellite value chain, offering flexibility, customization, cost efficiency, and bringing more resiliency and sustainability to satellite operators. The space logistics markets are still in the early stages, with few in-orbit demonstrations achieved in the past five years, paving the way for more ambitious demonstrations like refueling-ready satellites, reusable orbital transfer vehicles, large scale on-orbit 3D printing and integrated catalogs of space objects.

In the long run, Euroconsult’s report, which focuses only on commercial uncrewed services in Earth’s orbits, concludes that new assembly and manufacturing methods could reduce dependency on changing the way assets are used in orbit, as space logistics become the foundation of large-scale applications.

“There is a long way to go before seeing nodes and networks in orbit and a true supply chain, but we are beginning to see flight proven services and securing early customers”, says Maxime Puteaux, editor of the report. “Our analysis shows that these supply driven markets have yet to shift towards buyer’s markets.”

Euroconsult’s comprehensive analysis of the emerging space logistics markets details all you need to know about the on-orbit activities starting to mold the satellite market arena.

To read the1st edition of the Space Logistics Markets report, visit: this link or download a free extract.